How To Plan For Peak Rates Like a Debt Management Pro

If you’re in the real estate business and haven’t been living under a rock the last several weeks, you’ve probably seen infographics that…

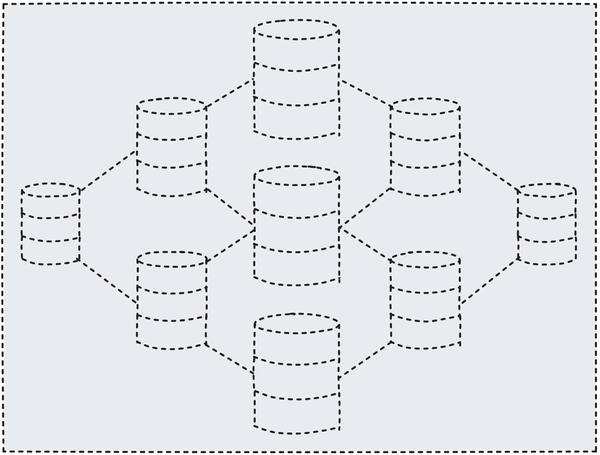

If you’re in the real estate business and haven’t been living under a rock the last several weeks, you’ve probably seen infographics that look something like this:

Since you’re reading this, your livelihood is probably dependent on the path of that line in one way or another. Floating rate borrowers in particular, tired of skyrocketing hedging costs, are worried about how much higher that line can go — after all, it’s already the steepest line in recent history.

Let’s take a look at what history can tell us about what’s probably coming, and how to prepare for it. But I’ll give you the punchline first: now’s probably the best time to be a floating rate borrower.

What Comes Up Must Come Down

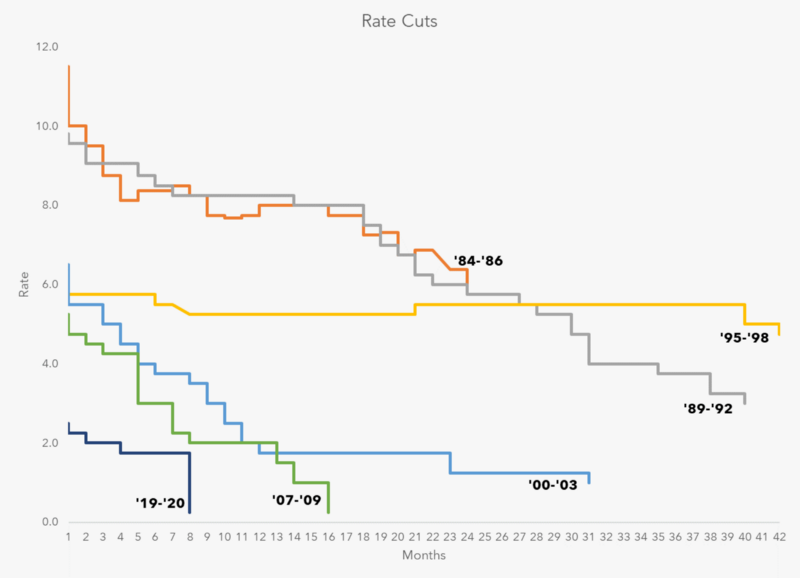

Historically, the Federal Reserve has a really bad habit of overtightening and sending the economy into a recession. Four out of the last five tightening cycles ended in a recession, which required the Fed to sharply reduce rates in order to help the economy recover. This current tightening cycle looks more and more likely to end in a very predictable fashion, despite hopes for a soft landing. The Fed doesn’t really work in subtleties.

While a lot of attention has been paid to the rapid increase in rates, it’s also important to consider how quickly rates tend to drop when it’s time for the Fed to cut. If you’re a borrower experiencing negative leverage, this is probably the concept you want to consider the most.

Consider that the current LIBOR Forward Curve peaks in January 2023 (as of Oct 12, 2022), and really starts dropping off at the end of 2023. Meaning, markets are expecting the Fed to be forced to start cutting again by the end of next year.

This makes sense, and seems to be in line with historical rate cut patterns, where the Fed starts cutting on average a little less than 9 months after the last rate hike.

Once the cuts start happening, they typically happen quickly. In the last two loosening cycles, the Fed cut rates down to zero in less than 18 months.

Additionally, any cursory review of Fed Funds in the last 30 years will show that we tend to stay in the troughs for much longer than we stay at rate peaks. In other words, while borrowing costs are going up, and it’s tempting to try to lock in rates, keep in mind that rates tend to fall shortly after the Fed is done hiking and usually stay low for a while.

Inverted Yield Curve

Okay, but what if this time is different? What if the Fed learned from past mistakes and isn’t completely shocking financial markets and the economy as a whole into a recession?

Well, that’s a possibility, but consider that the yield curve is currently inverted, and has been since July.

Even my mom knows that an inverted yield curve means recession is on the horizon. It’s literally never been wrong. Since recessions tend to be deflationary, and the Fed’s best weapon to fight a recession is to lower rates and get the money spigot flowing again, you can be almost certain that rates will start falling again within the next 12–24 months.

Debt Management — How to Plan For Falling Rates

There’s a couple of things we can do to prepare for rates falling in the coming months. We need to not only consider plans for new financings, but for our existing loans as well. Falling interest rates are a friend to floating rate borrowers, but an enemy to fixed rate borrowers. Let’s talk about how to manage each.

Fixed Rate Loans

If you’re considering closing on a new fixed rate loan in the next several months, it’s probably best to wait. If history repeats itself, as it often does, we’re probably somewhere close to the peak before the next loosening cycle. Fixing a rate now is only going to work against you. Prepayments are going to kill you and make it next to impossible for you to refinance the loan. Your best options will be:

- Get a floating rate loan instead. As the Fed cuts rates, your cost of debt will fall too. The prepayment flexibility will also make it much easier to refinance into a fixed rate loan later.

- Ask your lender to waive prepayment penalties. If you want the assurance of a fixed rate loan, or you’re prohibited from using floating rates loans because of company policy or guidance, do everything you can to alleviate or remove prepayment penalty risk. Your penalty cost will go up as rates fall and make it impossible for you to refinance into a lower rate later.

- Use short term loans. The goal is to be able to refinance into cheaper debt when financial conditions are more accommodative, use short term debt. Many short-term loans also include extension options, allowing you to push your maturity out another year if lending appetite isn’t what you need.

- Use swaptions as a prepayment hedge. If you’re already in a fixed rate loan and think you may want to refinance or sell in the next 2 years, it might make sense to buy a fixed receiver swaption. This type of hedge will pay you in the event rates fall, and can help offset any increased prepayment costs.

Floating Rate Loans

Floating rate loans might be the best options in the near term. The Fed has already started signaling that we’re near the end of tightening and can expect to start levelling out early next year. Looking back to our historical references above, this means we can probably expect rates to start coming back down by the end of 2023. However, there’s still near-term risk we need to manage.

- Use Interest Rate Caps. This will help protect you against any unexpected upside movement, while still allowing you to float down. Keep this short-term, and work with your derivatives broker to figure out optimal pricing.

- Use short-term loans. Lenders are more conservative right now, so limit your cost of debt by using short-term floaters to keep loan spreads as low as possible.

Final thoughts

As we move forward into uncharted waters, the question on everyone’s mind is going to be whether the Fed can actually maintain a higher rate environment, or will they end up slashing rates again like in previous cycles? Make sure you’re prepared for what comes next so you’re not left holding the bag in the next loosening cycle.

If you liked this article, consider following me and subscribing to email updates whenever I post an article. You can also follow me on Twitter or connect with me on LinkedIn.