Infographic: Why Swaps Make Sense For Great Debt Management

Trying something new here. Let me know what you think of the infographic format!

Trying something new here. Let me know what you think of the infographic format!

If you liked this article, consider following me and subscribing to email updates whenever I post an article. You can also follow me on Twitter or connect with me on LinkedIn.

Infographic Text

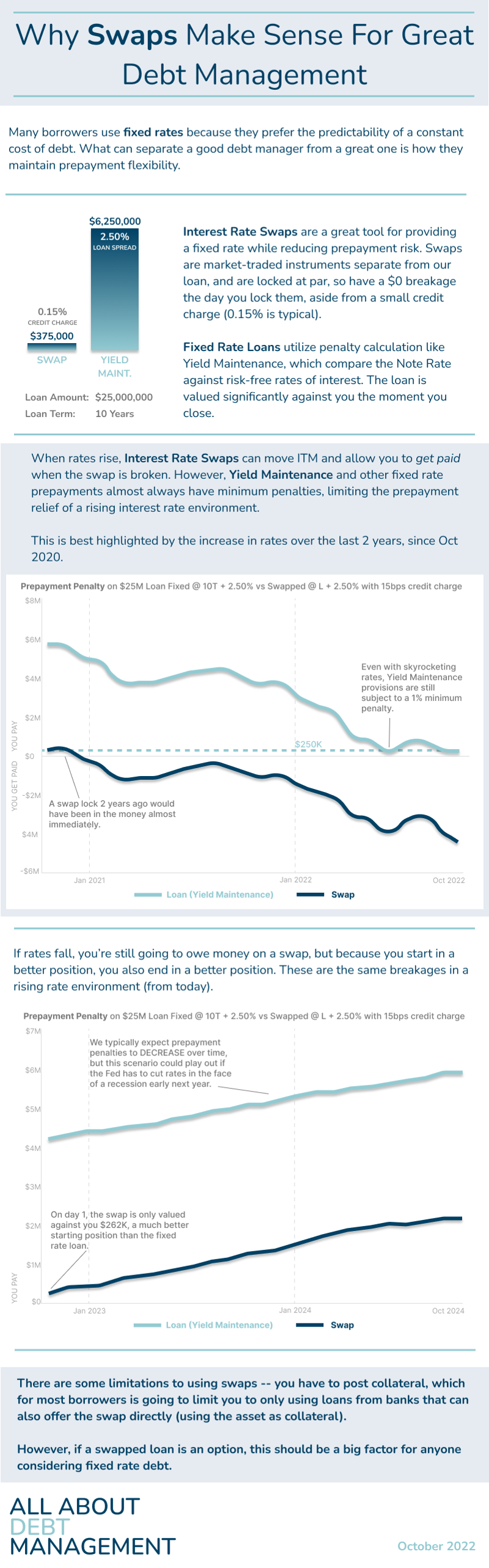

Many borrowers use fixed rates because they prefer the predictability of a constant cost of debt. What can separate a good debt manager from a great one is how they maintain prepayment flexibility.

Interest Rate Swaps are a great tool for providing a fixed rate while reducing prepayment risk. Swaps are market-traded instruments separate from our loan, and are locked at par, so have a $0 breakage the day you lock them, aside from a small credit charge (0.15% is typical).

Fixed Rate Loans utilize penalty calculation like Yield Maintenance, which compare the Note Rate against risk-free rates of interest. The loan is valued significantly against you the moment you close.

When rates rise, Interest Rate Swaps can move ITM (in the money) and allow you to get paid when the swap is broken. However, Yield Maintenance and other fixed rate prepayments almost always have minimum penalties, limiting the prepayment relief of a rising interest rate environment.

This is best highlighted by the increase in rates over the last 2 years, since Oct 2020.

If rates fall, you’re still going to owe money on a swap, but because you start in a better position, you also end in a better position. These are the same breakages in a rising rate environment (from today).

There are some limitations to using swaps — you have to post collateral, which for most borrowers is going to limit you to only using loans from banks that can also offer the swap directly (using the asset as collateral).

However, if a swapped loan is an option, this should be a big factor for anyone considering fixed rate debt.