The CRE Debt Management Tech Stack

Every year, the Center for Real Estate Technology & Innovation releases a survey of PropTech VC’s to find out the impending trends and…

Every year, the Center for Real Estate Technology & Innovation releases a survey of PropTech VC’s to find out the impending trends and opportunities survey respondents believe are coming that year. One of the highlights was the belief that 2022 was going to be the year of the “installation phase” for CRE — that is, a time when tech enabled owner-operators will begin to show signs of competitive advantage over peers less willing to adopt.

While 2022 didn’t quite pan out according to VC expectations, there are some early signs that seem to be pointing towards this “installation phase”. CRETI found that more capital is being allocated towards companies with an eye towards financial discipline, or companies that have found their product-market fit and standing on their own. Another CRETI survey found that 20 percent of real estate owners and managers were in the early stages of their “installation phase”.

While I personally believe we’re in the midst of a shift towards tech-enabled advantages for market participants, it’s unlikely that major competitive advantages will be seen this year. After all, adopting technology is one thing–learning how to use it effectively is another.

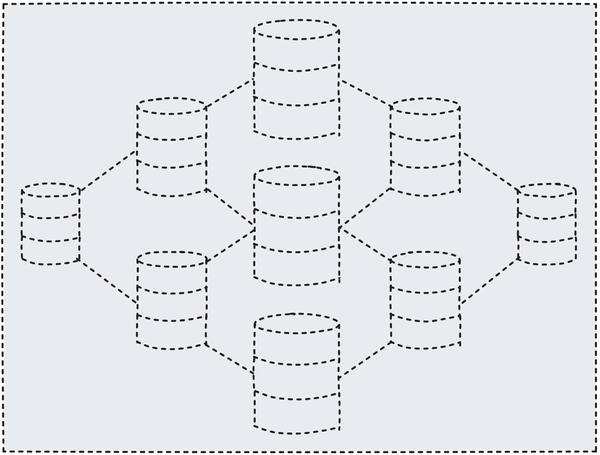

Building a Tech Stack

Last week we talked about why Debt Management should be considered its own market category. This week we’ll take a look at what it takes to build a debt management tech stack. We’ll also touch on the secondary systems that can support a fully-functioning debt management system.

Debt Management Software

Maybe this goes without saying given the title, but you need a way to track and work with your loan information. Combine it with live rates, property financials, covenant tracking, etc. If that platform can support lender compliance, even better.

Accounting Software

You can’t run your business without it, and it provides critical property data. This will work with your debt management system to keep track of NOI data, verify loan balances against balance sheet information, and provide other accounting information necessary for lender compliance.

Investor Management

This type of software helps gather the portfolio performance information you need for your investors. Some platforms can even calculate distributions owed to your investors based on asset performance. This can complement debt management to manage your WACC.

Budgeting & Valuation

Helps you to make forecasts about your properties based on your assumptions and historical information. This can include comp data and budget assumptions. This type of data helps you predict the likelihood of defaulting on a loan covenant and front-run lender compliance.

Business Intelligence Tools

As a general tool, this can integrate with and help you understand your data from a variety of sources. You should expect certain categories of software, like debt management, to include some level of business intelligence to help manage debt portfolios at an executive level.

Deal Acquisition Software

This helps manage deal activity at the asset level. Track, manage, and complete deals before passing the debt information off to the finance team or a controller.

Putting It All Together

Building an effective tech stack is hard. My only real piece of advice is to take the time to understand what your company needs, and to build a tech stack with those primary needs served first. Your secondary and tertiary systems should serve and be compatible with the primary systems.

Last thing — since I am coming at this from a Debt Management point of view, my next post will be able how effective debt management practices will make real estate more profitable.

If you liked this article, consider following me and subscribing to email updates whenever I post an article. You can also follow me on Twitter or connect with me on LinkedIn.