The Fundamentals of CRE Debt Management

I think one of the most difficult aspects of building debt management software is defining exactly what that means. It’s also one of the…

I think one of the most difficult aspects of building debt management software is defining exactly what that means. It’s also one of the more interesting thought exercises to walk through. It’s something every real estate firm does, but everyone has their own practices and methods for it. In some firms, it’s a joint exercise between executives, in others it’s up to the asset managers, and in others still there are dedicated finance teams to stay on top of debt portfolios.

To accomplish their task, processes are usually set up to solve specific problems as they come up. Organize files in a drive system so we can read docs. Go run a prepay calc when we’re thinking about a disposition. Create a spreadsheet to keep track of Lender Compliance requirements. All one-off solutions to fix specific problems.

There’s nothing wrong with this approach, I imagine most best practices started life as people creating ad hoc processes to solve problems as they came up. Eventually, processes are refined and connected to create best practices. These practices have existed for Asset Management for a long time. You would be hard pressed to find an asset manager that couldn’t easily fill into a similar role at a new firm. However, I suspect it’s harder to find the same similarities when it comes to debt management practices.

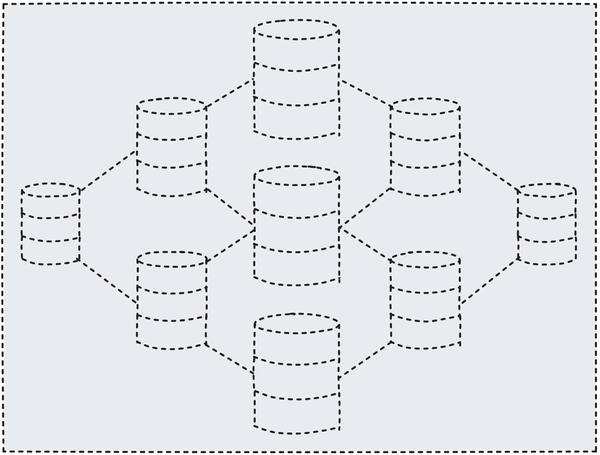

I’ve had the privilege of seeing the practices and procedures of dozens of firms over the last several years, which I’ve tried to distill the best of into three distinct capabilities. These capabilities have been designed in such a way that you do not have to do all 3 simultaneously, but rather build on one another and can be implemented over time.

Decision Making Capability

The foundational capability for any management practice is to enable decision making. The same is true for both asset management and debt management. These practices exist so that you can make timely, informed decisions.

To master this capability, you want to be able to fulfil the following elements.

- Locate loan information quickly — This will usually involve creating quality loan abstracts and linking the data back to the original reference in the loan docs.

- Create reference calculations that can be updated easily — Think about the different data points you need to reference frequently, or those where timeliness is an advantage. Loan Cashflows, prepayment penalties, financial covenants (like DSCR and Debt Yield), and supportable loan amounts are all data points you may want to have access to without a 2 day waiting period.

- Access Systems — Management/Executives generally don’t want just anyone to have access to this info, so you’ll need to create some sort of access system for this. It could be as simple as a drive service with user access permissions, or it could be as much as a dedicated debt management service.

Just so we don’t lose the forest for the trees, remember that the goal of this capability is that you are able to provide timely, accurate information to the people that need it, when they need it. The degree to which you build this out is dependent on your firm’s needs.

This is just the foundation, once this is in place, we can build the next layer on top of this…

Loan Administration Capability

As we master control over our loan information, we enable ourselves to take on more sophisticated debt structures. These sophisticated debt structures often mean a greater administration burden. Don’t worry though, because we anticipated this and began laying the groundwork for this well ahead of time.

Just like last time, there are elements to this capability that we need to be able to master.

- Lender Compliance — Am I the only one who thinks it’s funny/odd that the lender relies on the borrower’s math to prove they’re in compliance? Regardless, we need systems in place to collect deliverables, create/update calculation workbooks, review compliance packets, and actually deliver them on time.

- Loan Management — This is a category of items that entails things like construction loan draws. This won’t apply to everyone, but for borrowers that use high-touch debt, this is a must-have. You’ll need a system in place to track who made a lender request, what it was for, how much it was for, what deliverables had to accompany it, and who approved the request.

- Debt Valuation — For most, this practice is largely dependent on what kind of investors you have, and whether they want to see this sort of information. Thankfully, if you decide to do something like this in-house, most of the effort to create a calculation engine is front-loaded, and the maintenance is pretty straightforward.

I’m sure there are other elements to this capability, but this will cover the big ticket items. Once this capability is mastered, we can move on to the last capability.

Strategic Management Capability

We’ve thus far managed to gain mastery of our Decision Making Capability, as well as our Loan Administration Capability. These two capabilities have allowed us to really become sophisticated in the way we make decisions around and administer our loans. However, we now also need to make sure that we stay on top of ever changing debt markets and are using the most efficient financing that we can.

- Portfolio Analysis — This means we’re going to start looking at our debt portfolio as a whole, instead of as an asset-by-asset decision point. Do we have processes in place that allow us to answer questions like the impact a portfolio-level hedge will have on our projected debt cost? Can we see how a new financing will affect our overall Debt Yield?

- Debt Optimization — Continuing our line of thought above, this is a specifically aimed at finding ways to optimize our debt structure. For example, is there a way for us to shift debt burdens around to properties that can fetch the cheapest debt in order to pay down more expensive loans? Should we be using credit facilities or lines of credit instead?

Given how abstract this capability is, there’s virtually an infinite number of ways to manage this and create this capability depending on your firm’s makeup and needs.

Summary

There’s a need to create debt management best practices for CRE. Without standard practices, it’s impossible to set policies, implement any sort of controls, or even understand how certain habits are costing you money.

I’m interested in hearing from you. Are there any capabilities you think should be included here that aren’t?

If you liked this article, consider following me and subscribing to email updates whenever I post an article. You can also follow me on Twitter or connect with me on LinkedIn.