(The Lack Of) Data Standardization in CRE

I want you to imagine a scenario with me for a moment...

I want you to imagine a scenario with me for a moment. You've been an intelligent real estate investor for a while, and have an excess of cash that you want to diversify into some alternative investment other than real estate. So, you call up your stock broker and you decide to ask about buying some shares of Apple ($AAPL).

However, you're a savvy investor. You've never made an investment without doing your due diligence.

You: "Hey Jill, can you run some comps for me? I want to see how Apple's cashflow statement compares to Microsoft. Can you tell me how their Net Income compares?"

Jill: "Sorry Caleb," (in this imaginary conversation you're also named Caleb), "it's gonna be a few hours before I can run that analysis. You see, Apple calls that section of their cashflow statement 'Cash from Operating Activities', while Microsoft calls it 'Cash from Operations'. In fact, every section of their financials is the same story, it's going to take me some time to unravel and match it all up."

Doesn't that sound familiar? How many CRE operators now struggle with this exact same sort of comparable exercise because their property managers all use different accounting trees?

CRE has a problem that it's struggled with for years. That problem is data standardization.

Why No Standardization?

The problem is two-fold. First, by it's very nature CRE is just non-standardized. Every property is different. Every business plan is different. Every capital stack is different. We've developed a language that we can all use to understand each other, but that language was meant for humans, not the digital world. Second, there's no central authority in CRE to dictate or oversee the process of devising a standard that all CRE data has to conform to.

This exists in other industries – the SEC dictates how company financials have to be reported and audited so that investors can easily understand the financial health of companies. The CFTC manages financial derivatives, so that all interest rate swap and cap data is uniform and can be reported into a swap data repository. There's no equivalent within CRE.

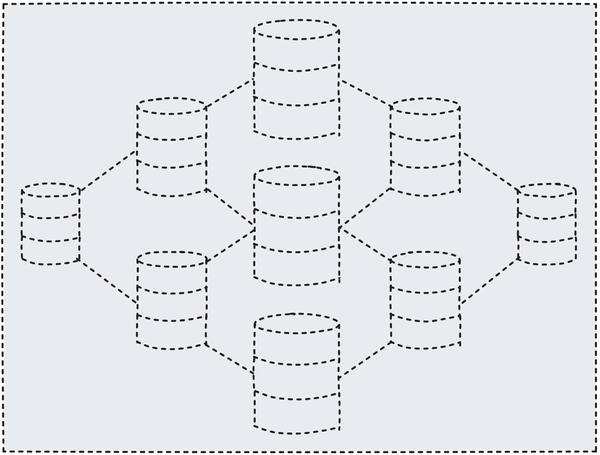

This means that data is often siloed and maintained in different formats by different industry stakeholders. Operator to operator, broker to broker, and even lender to lender, this data is held in different structures and can't be easily shared (not that many stakeholders are trying to do so).

Despite the industry being so large, it's extremely fragmented, with no single player able to hold much influence over how this data is structured.

Industry Initiatives

As the industry becomes more tech enabled, having a standard for data becomes important. It's next to impossible to utilize a SaaS product if there's no standard format. It's even more difficult to take advantage of publicly available data if there's no way to compare your data to other data sets.

There are several players working on this problem. LoanBoss is pioneering the standardization of loan data (full disclosure, I'm on that team), while companies like Reonomy and RCA have been working on problem of structuring property data for years. These standardized data sets and APIs help streamline the problem of data aggregation.

Driving Standardization

The growing use of technology and data analytics in our industry is helping to drive data standardization. As we move away from an Excel-only way of doing business, and into one where we save Excel for the complex stuff, there's more pressure on companies to standardize their data in a less fragmented way. Using other technology tools to help streamline operations and help in decisions making processes has made the need for standard data structures more apparent.

Standardized data can help ensure that technology solutions are able to effectively communicate with each other and that data analytics are based on consistent and accurate data.

Overall, while data standardization in commercial real estate is still an evolving area, there are promising signs of progress. As the industry continues to embrace technology and data analytics, the need for standardized data is going to become increasingly important, and efforts to develop common standards will likely continue to gain momentum.

I expect as artificial intelligence tools become more accessible and easier to use, we'll see an acceleration in standardization. AI will make it much easier to transform existing data into something that can be more easily utilized.

If you liked this article, consider following me and subscribing to email updates whenever I post an article. You can also follow me on Twitter or connect with me on LinkedIn.