What The Fed?

The Federal Reserve has two conflicting priorities, and at their Mar 2023 meeting chose not to directly address either. What the Fed?

Last week, during the fallout of SVB, Signature Bank, and Silvergate, the FOMC decided during it's March 22 meeting to hike Fed Funds by 25 bps. This decision came pretty much in line with futures markets expectations, and signaled one more hike in May before pausing, also mostly in line with futures markets.

Despite this seemingly expected behavior, markets reeled following the announcement, with the 10T falling 20bps between the decision and market close, and continuing a downward trend into Friday.

This is not the sort of response you expect for simply behaving the way markets expect you to behave. Why is this?

Before I get into why I think markets responded the way they did, let me just point out that I'm no macroeconomic expert, the FOMC more than likely consists of a panel of people much smarter than I. This is just a few observations I've seen pointed out by other commentators that make me wonder if the policy decision the Fed took was the smartest one.

Let's Rewind

Let's look back to why we're in this situation. We all know the storyline so I'll be brief:

- 2019 - Life as normal

- New virus, what's this?

- Boom, COVID. We all go on lockdown, "For 2 weeks, we promise"

- It's longer than that. WFH becomes a thing.

- We have a short deflationary period as we adjust to a new way of life.

- Stimulus checks to keep things moving. Most of us don't need it, so we buy $GME instead.

- More stimulus checks

- Another one

- Another one -- wait, aren't we past this now?

- Inflation has been picking up. It's transitory though, we promise. It's because of the ships parked off the CA coast.

- Nothing to do with pumping stimmy checks to people who don't need them to buy a shrinking supply of stuff.

- We keep watching grocery bills go up for a year, but the Fed doesn't do anything because, "Inflation is Transitory".

- Fast forward after a year of hearing the word "transitory" more times in 12 months than I've ever heard it in the rest of my life combined, and the Fed admits it was wrong.

- We're behind the 8-ball though, so we've gotta hike, we've gotta hike fast, and we've gotta do it now.

- Mar 2022 - Mar 2023, Fed Funds moves from 0.25% to 5.00% upper bound.

- Mar 2021 - Mar 2023, the 10T moves from ~1.60% to ~3.40%

Inflation, Inflation, Inflation

So we're in the place we're in because the Fed has decided it's #1 priority is to keep inflation in check. That's the biggest problem facing the long term economic health of the United States.

Makes sense if that's your priority. If that's the big issue, I can take you at your word, let's fight inflation! Hike baby, hike!

Bank Failures

I won't go into grueling detail about how and why banks are failing, but if you do want to read more, because maybe you're the last person to read anything about it, you can check out a detailed description here.

In case you need a refresher, here's a quick recap of the banking sector stress.

Falling Deposits

Bank deposits are the lifeblood of banks. When you go put your money in a bank, it allows the bank to deploy those assets into something that can make money. For basically all of banking history, deposits have only GROWN. Even back in 2007 - 2008, bank deposits grew at banks, they never decreased.

However, if you squint your eyes and glance towards the right side of this graph, you'll see a big spike in bank deposits where deposit growth accelerated off-trend (you'll see my very scientific trend line in red).

Let's forget for a moment about why deposits spiked, we can argue about that for days. I just want to point out that there seems to be some artificial acceleration away from the historical trend, and if that's the case, then this pull back down may have been unavoidable. In fact, if we argue mean-reversion, we may not even be close to the end of deposit deflation.

In fact, if we zoom into this chart, we can see that deposits at banks peaked about 9 months ago.

Our Challenge: Making Depositors Whole

Ok, so if we're a bank, deposits across our entire industry are falling. That means to fix our problem we either need to a) keep deposits from falling, or b) liquidate some assets for cash.

Given that falling deposits are a problem across the entire banking sector and not just our bank, we're unlikely to fix that problem. The only banks who have a hope of at least maintaining their deposits are the Big 4 banks (JPM, BofA, WFC, and Citi), who may benefit from a flight from smaller institutions that are seen as more risky.

With that in mind, let's take stock of our situation.

Consumer Loans

As bank, I issue consumer debt. Things like Credit Cards and HELOC loans. Those balance have risen and continue to rise. I make those loans with depositor money, which is leaving in droves.

Those probably aren't going to go back down of their own accord. If we check the unused balances of those revolver lines we see the amount of credit offered continue to rise alongside the amount of credit used. Yikes.

The Prime rate, which nearly all consumer revolving debt is based around, steps up in lockstep with Fed Funds. As we all know, that's skyrocketed over the last year.

What this adds up to is MORE debt that costs MORE to maintain, which means less cash to pay down balances (since more is going to interest), so this credit increase is unlikely to subside on its own. Higher interest also means higher minimum payments, which takes more money out of my bank account (deposits).

Ok, so unless we start calling in credit limits and cancelling HELOCs, this isn't a great place to start. I'm already losing deposits right and left, I can't risk giving my depositors yet another reason to leave, so this is probably a non-starter.

Consumer Mortgages

In theory, this should be a good place to turn. We just stop originating or buying new mortgages, and just let refi's roll off our books.

Trouble is, this seems to be everyone else's playbook too. The most recent data we have on this is Q3 2022, but even then originations were trending down. I bet when Q1 2023 data comes out we'll see a massive slump downward.

But of course, in this rate environment, who is going to refi of their own accord? Currently, mortgage rates are floating between 6% and 7%.

Meanwhile, only ~9% of mortgages (as of Q3 2022) were north of 6%. I doubt any rational person is refinancing their loans.

The only people paying off their mortgages are those who are selling their homes. Of course, home sales are falling as mortgage rates rise, so the loans you need to roll off are rolling off at a slower rate than in recent history.

Valuing Mortgages

If you remember bond math from college, you'll recall that the price you pay for a bond is correlated to the bond's coupon and the yield you're looking to gain.

- If the bond's coupon = the bond yield, you buy the bond at par (i.e. face value)

- If the coupon > yields, you buy the bond at a premium (i.e. more than face value)

- If the coupon < yields, you buy the bond at a discount (i.e. less than face value)

If you're a bank with these loans in a balance sheet, you've got quite the dilemma. You can't get borrowers to refinance their loans with somebody else, and you can't assign your position either, because you'll take a pretty hefty loss. If your balance sheet is something similar to the national average, that means you can't assign your position to 90% of you mortgage portfolio without taking a loss.

Commercial Real Estate Debt

This is a big issue for small banks. According to the Fed, nearly 70% of CRE loans are held by banks outside of the 25 largest. As of Feb, that's 70% of $2.898 TRILLION, which is still north of $2T.

If you're a bank looking to assign a loan position, you're more than likely going to use a calculation called Cash Equivalency -- the amount of cash paid or received to assign a position. It's pretty similar to bond math, and the premium/discount relationships are the same.

Historically, roughly 50% of CRE debt is fixed, and roughly 50% is floating. This means that at least half of your portfolio is going to be deeply affected by the long-term treasury moves. If you're a really small bank, your ratio probably leans fixed. Let's take a look at where you would have been underwriting loans the last few years.

So we've underwritten our loan portfolio in the following:

- 2020 vintage: sub 1% Treasury Rates

- 2021 vintage: dancing around 1.50% treasury rates

- 2022 vintage: we start the year at ~2% and end ~4%

Do you know any CRE operators who didn't refinance every single loan they possibly could in their debt portfolios in 2020 - early 2022?Ignoring spreads for a moment, every single loan we've underwritten in the last several years just keeps getting devalued. I think it's safe to say that at least 50% of outstanding CRE loans were underwritten since Jan 2020, meaning small banks are left holding the bag on loans they can't liquidate to appease depositors that are drawing down funds en masse.

A Perfect Storm

If you've been listening to debt brokers, you know banks are in risk management mode -- this means no new loans, which means less credit is being spent (worsening the cash spend/drawing down deposit problem), and a potential credit crisis is looming.

If banks can't lend new money because deposits are dropping, and the 2023 debt maturity wall that everyone is talking about is looming, then how are CRE borrowers going to refinance their properties? If borrowers can't refinance their properties, how are banks (small banks in particular) going to roll that debt off their balance sheet to get liquidity?

Only time will tell, but this problem of shrinking deposits doesn't seem like it's going to resolve itself anytime soon.

Conflicting Priorities

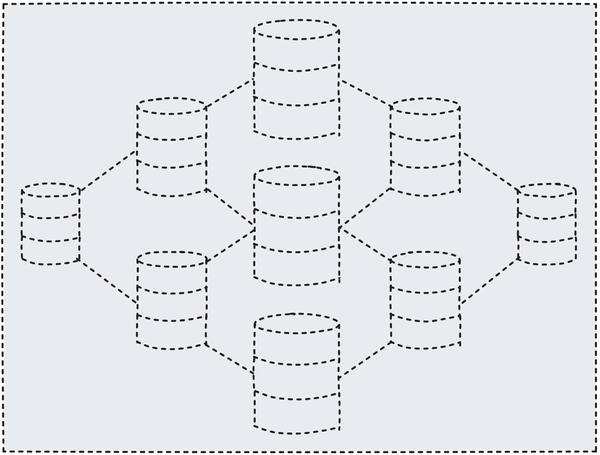

Now the Fed has two big issues to contend with.

- A suffering banking sector that desperately needs some interest rate relief to get some liquidity. This priority would call for an DECREASE in rates.

- An economy reeling from 2 years of historically high inflation. The only tool the Fed has to control inflation is interest rate policy. This priority would call for an INCREASE in rates.

Here's a good visual of the problem at hand.

The Fed Meeting - March 22, 2023

In the most recent Fed meeting, the Fed made what might have been the worst decision of all. They had two moves that would have signaled to the market that they know the problem they have to face down. The could hike rates 50 - 75 bps and signal to the market that they believe banks are as sound as the Fed is claiming they are, or they could have cut and signal that they recognize the weakness of the financial sector and are taking action.

Instead, they took the middle of the road path. They hiked 25 bps.

The Signal

The signal to the financial sector with this policy decision is that the Fed was once again caught sleeping at the wheel. The banks that the Fed are supposed to be regulating could get themselves in a long position where their asset portfolios are worth less than their liabilities. This policy move just signaled what we all already knew, which is the Fed really isn't sure how strong the banking sector is.

Of course, they can't come out and say that, that would cause panic and a self-fulfilling prophecy. But this latest rate decision just confirmed that the Fed isn't sure how long they can sustain this tightening cycle. Their best bet is just to try and get more dry powder they can cut later this year.

BTFP

If you needed some data showing that the banking sector isn't in as great of shape as the Fed wants you to believe, you only need to look at the Bank Term Funding Program. This is a brand new program, in response to the SVB collapse, that provides emergency lending to banks against certain collateral (like Treasurys), valuing those assets at par. It's going to be a critical program to keep smaller banks that didn't hedge there long exposure.

This is how the program works. If you bought a 10T at 1.90% 2 years ago and need liquidity when yields are ~3.40%, the market value on those bonds is 89.7 while par is at 100.0. Typically, repo markets would be used to secure this sort of liquidity. However, the amount of collateral needed to secure that position is greater than the cash you need (due to market value of securities). This leaves banks in a bind when enough bank deposits get withdrawn. The willingness of the Fed to potentially hold these securities to maturity and lend against their par value, for an extended amount of time, is what makes this stand out.

You can take a look at the Fed's balance sheet to see how much this is getting utilized. The Fed's balance sheet is up $400B in just 2 weeks!

One more thing about this program -- these loans are just meant to provide emergency liquidity to banks for one year. Do you think that a bond valued at 89.7 is going to recoup enough value that those banks can pay back the $400B in March of 2024? Not unless rates come back down...

Conclusion

So, in summary, the Fed has two big conflicting priorities right now. One says it should keep hiking, and the other says it should start cutting. The Fed took the middle of the road path, neither committing to continued hikes (to bring down inflation), nor to providing rate relief to banks. Instead they hike 25 bps, maybe committing to another 25bps hike, and giving some emergency lending to banks that they cannot even hope to pay back in a year.

I think what the Fed has done is told us that we're getting ready to cut again by the end of the year. This last hike, and the expected hike in May, is just to build in some more dry powder to slash away. The Fed knows the banks will need emergency liquidity beyond a year at current rate levels, so their plan is to buy themselves enough time to let current rate levels do their work on inflation and let the banking sector issue become next year's problem.

Here's to hoping that they're smarter than me and not picking a priority was the right move...

If you liked this article, consider following me and subscribing to email updates whenever I post an article. You can also follow me on Twitter or connect with me on LinkedIn.